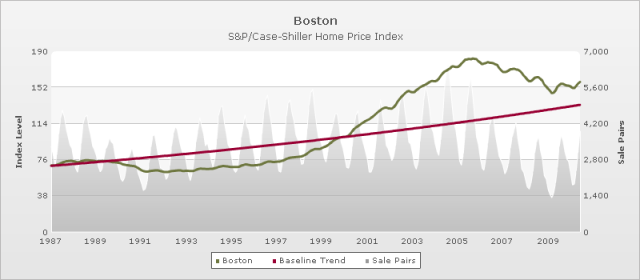

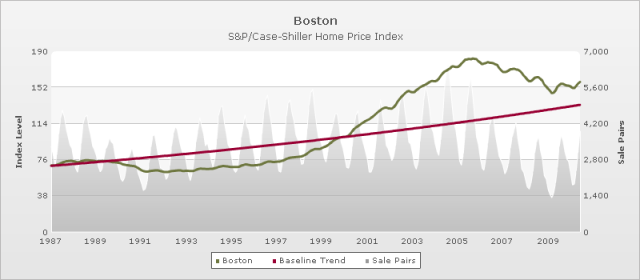

From MacroMarkets: The top two charts illustrate the gap between the S&P/Case Shiller Home Price Index and its baseline trend level. The baseline trend extrapolates the average rate of Index growth before 2000, the year when prices took off in many real estate markets. The current gap for U.S. National is -3.9%, and for Boston it’s +15.3%. By this measure, U.S. National has overshot downwards slightly, and Boston prices still have a way to fall. The S&P/Case Shiller Home Price Index is not adjusted for inflation.

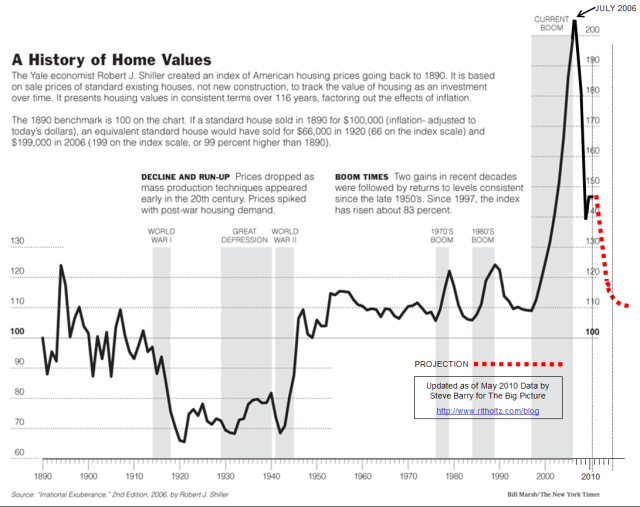

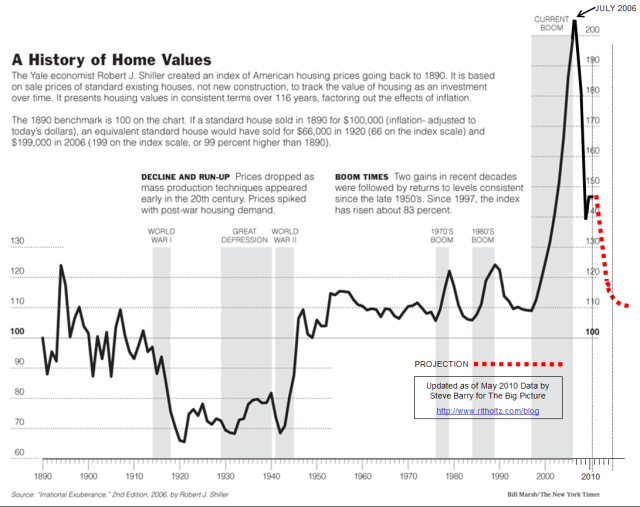

From The Big Picture: The bottom chart shows existing-home prices over time, adjusted for inflation, with a forward projection. (Courtesy of the The New YorkTimes, as modified by Steve Barry for The Big Picture.)

Metropolitan Boston (Image via Wikipedia)

Some experts now suggest the bubble is over. Is it finally a good time to buy a home? The perennial question has gained salience in this troubled economy. The answer depends, of course, on one’s view of home prices. Have they bottomed, or will they fall further? Recently, David Leonhardt wrote a provocative article in The New York Times, in which he tried to sort out this tangled question.

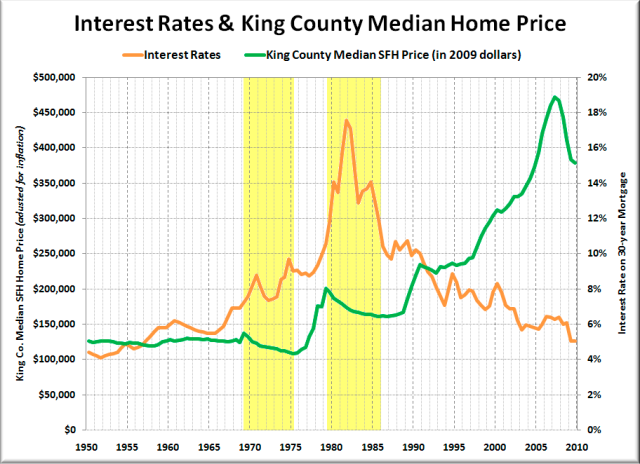

Housing economists are sharply divided on the issue, he explained, and fall into two distinct camps. One group cites historical evidence that home prices track inflation. This camp won’t deny that home prices rose roughly with incomes between 1970 and 2000, but that was an exception, they claim, caused by falling interest rates and government programs to encourage home ownership. They argue that prices still have some 30% or more to fall, nationally, before returning to their pre-bubble inflationary growth. Houses will then be a lot more affordable for a lot more people. This group I’ve dubbed the Populists.

The other camp I will call the Optimists. They argue that home prices track, not inflation, but income growth, which since 1970 has risen a good deal faster than inflation. These economists rely on more recent data, dismissing the older data used by the opposing camp as unreliable. In this view, as we grow richer, we spend more on housing — so our housing expense does not decline as a percentage of income as does our outlay for staples. The chart to the left from The Times illustrates this point.

The other camp I will call the Optimists. They argue that home prices track, not inflation, but income growth, which since 1970 has risen a good deal faster than inflation. These economists rely on more recent data, dismissing the older data used by the opposing camp as unreliable. In this view, as we grow richer, we spend more on housing — so our housing expense does not decline as a percentage of income as does our outlay for staples. The chart to the left from The Times illustrates this point.

The top two charts, above, reflect the Optimists’ assumptions. Even so, you can see that Boston area prices still have a way to fall. The bottom chart shows the Populists’ view, with prices poised for a much bigger drop.

In the long term, I lean to the Optimists’ view, for two reasons that could be captured by the terms, scarcity and vanity — not necessarily in that order of importance. Both drive up home prices. Scarcity of land is particularly acute in Greater Boston, an older, built-up city. Vanity has always moved folks to keep up with the Joneses, or if wealthy, build or buy a trophy house to advertise their success.

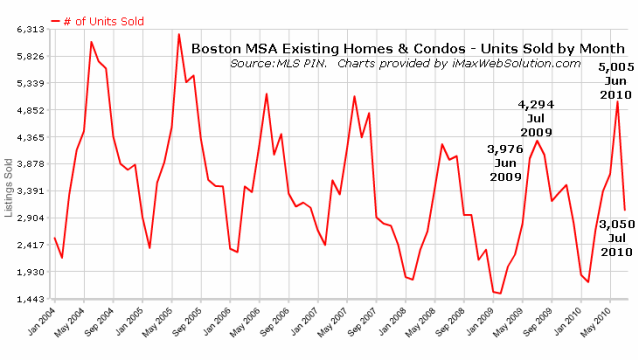

In much of the country, at present, inventory is being added at a faster rate than it can be absorbed, while many home buyers continue to sit on the sidelines. This has led to dire predictions of further steep declines in home prices. Like politics, however, all real estate is local. Is this a good time to buy? In the Boston area, sales were up 10% from last year through August. Let’s see how well prices hold up here as the year progresses.

We’re recovering from an unprecedented bubble. Whatever the pundits may say, we should be wary of inferring too much from the past. It may not be prologue this time.

Related Articles

As they have for several months, home prices continued to gain in July, but at a slowing rate, according to the closely watched S&P/Case-Shiller Home Price Index in its latest, September report(see chart, which is seasonally unadjusted).